Nav

Elevating online financing for small businesses

Nav’s financing helps small businesses to saving time researching and access the best lending options so they can get back to doing what they do best: running the business

The Challenge

The Goal

The financing experience is overwhelming and unintuitive for small business owners—it's filled with complex language, requires significant time and effort, and assumes a level of financial knowledge many don’t have.

💡

Deliver personalized financing recommendations

⚡

Streamline the online funding application process for highly qualified users.

📄

Create cohesive financing experience

📊

Equip users with simplified tools and metrics for confident decision-making

Design Approach 1

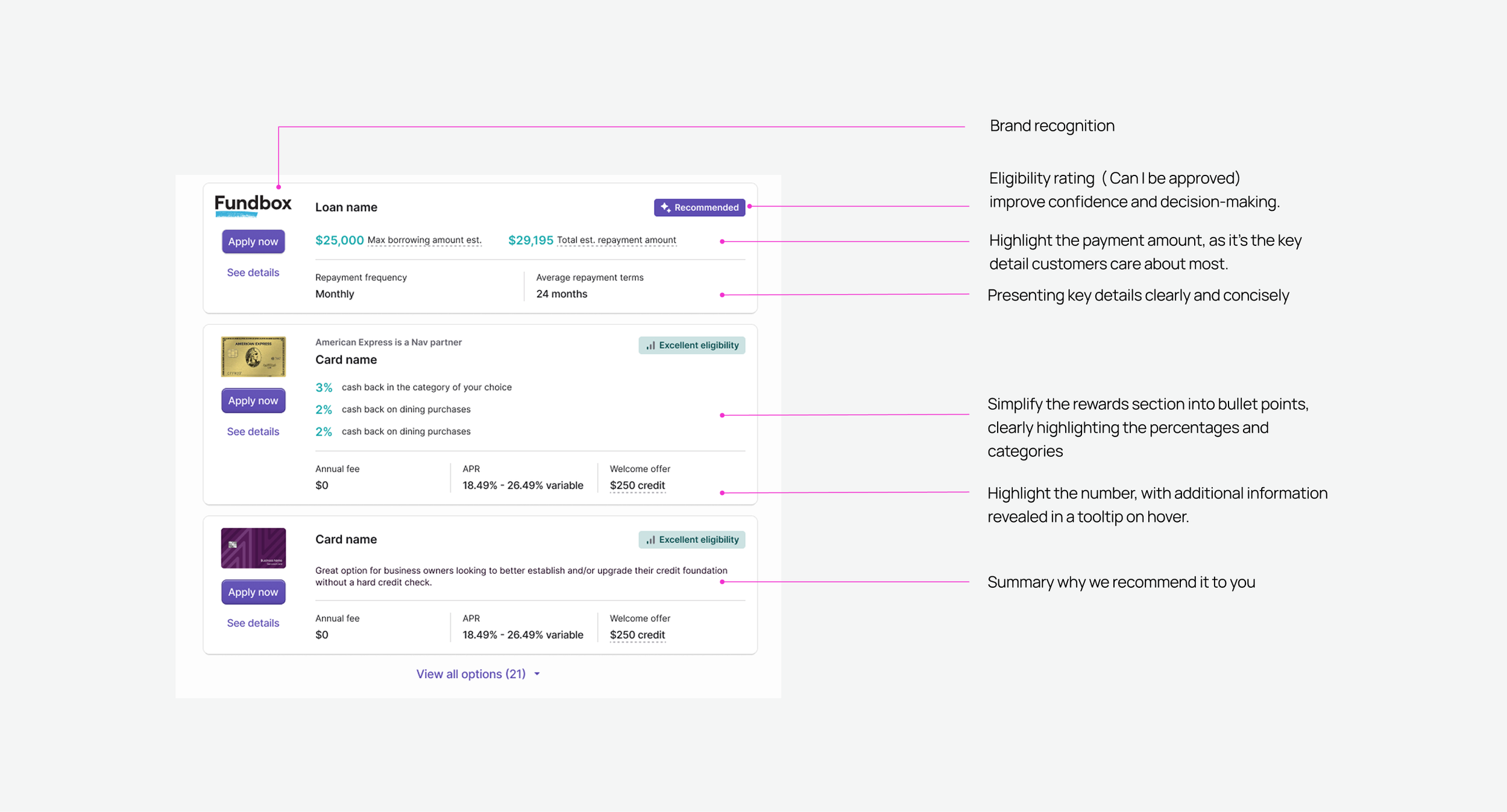

Minimize the learning curve with essential card design

A key element of this new experience is the option card. This card serves as the core touchpoint where customers can quickly understand each financing product. After user research and multiple design iterations , we arrived at a clean, intuitive layout that highlights the most important details—making it easy for users to answer critical questions like:

How much money I can borrow

Can I be approved

Can I afford it?

Design Approach 2

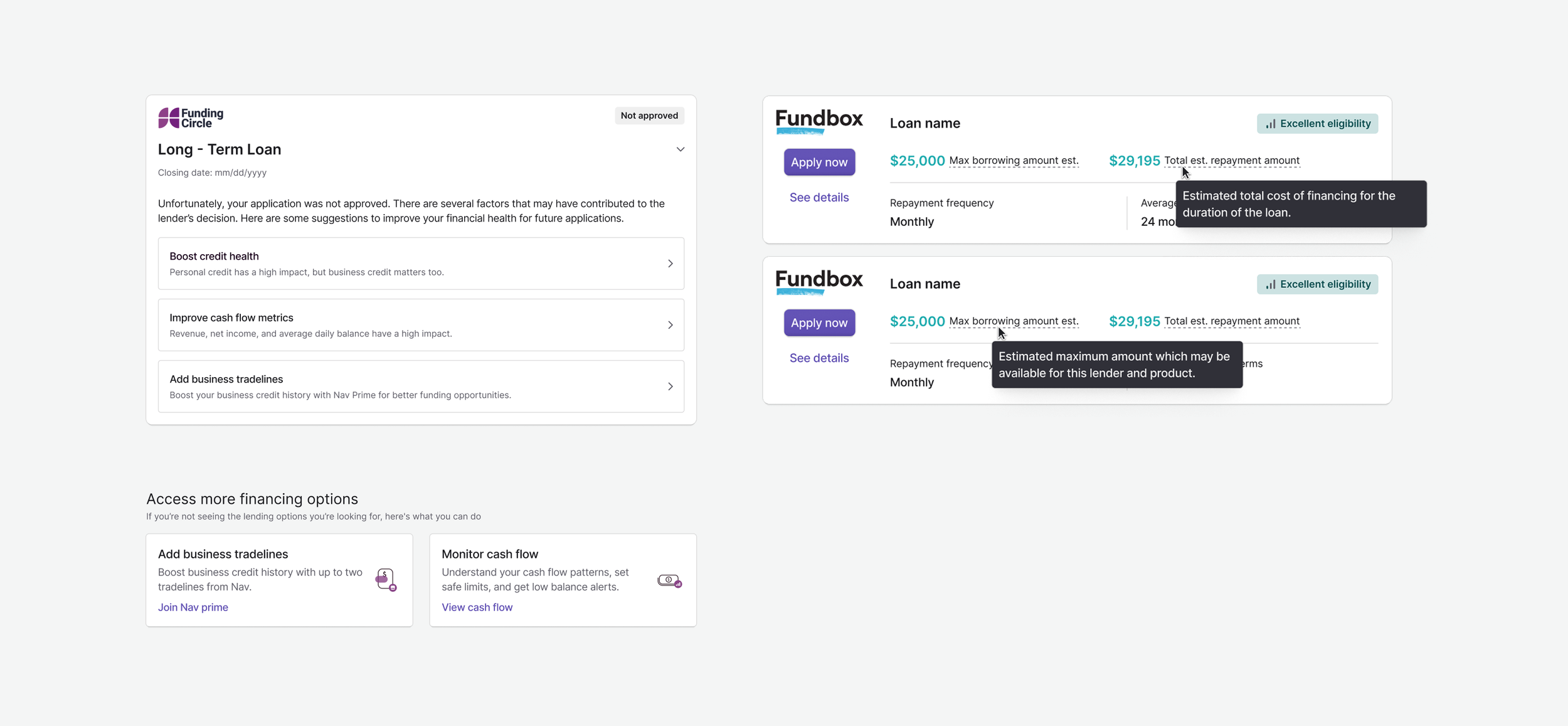

Builds confidence, helps customers make informed decisions

Another key element for this experience is “Borrowing power”. It gives small business owners a clear understanding of how much they’re likely to qualify for—before they apply.

Design Approach 3

Educate users with clear, approachable content

All respondents expressed the need for more education around business financing. How can we weave bite-sized educational content into the experience in a way that’s quick and easy for small business owners to understand

Design Approach 4

Present financing options tailored to each user’s qualifications.

Figure out the filtering system that helps users quickly and easily find financing options tailored to their specific needs